This post may contain affiliate links. If you make a purchase through links on our site, we may earn a commission.

I Needed an Emergency Fund – Do You? Digit.co Review

I Admit It… I'm a Terrible Saver – But Digit.co Changed That for Me!

I'm going to be super honest with you right now. I've bounced checks. Yep — I've paid overdraft fees. It's annoying as hell to. Especially since overdraft fees can be around $35 these days. Granted, I haven't bounced a check or overdraft my account in some time. Thank goodness. I do have overdraft protection – but I use a credit card for it. Which… well, we all know credit card debt is not smart. I am using the snowball method right now to pay off my credit card debt. And though nothing can instantly wipe out debt (besides winning the lotto or some kind of windfall) – it is slowly going down.

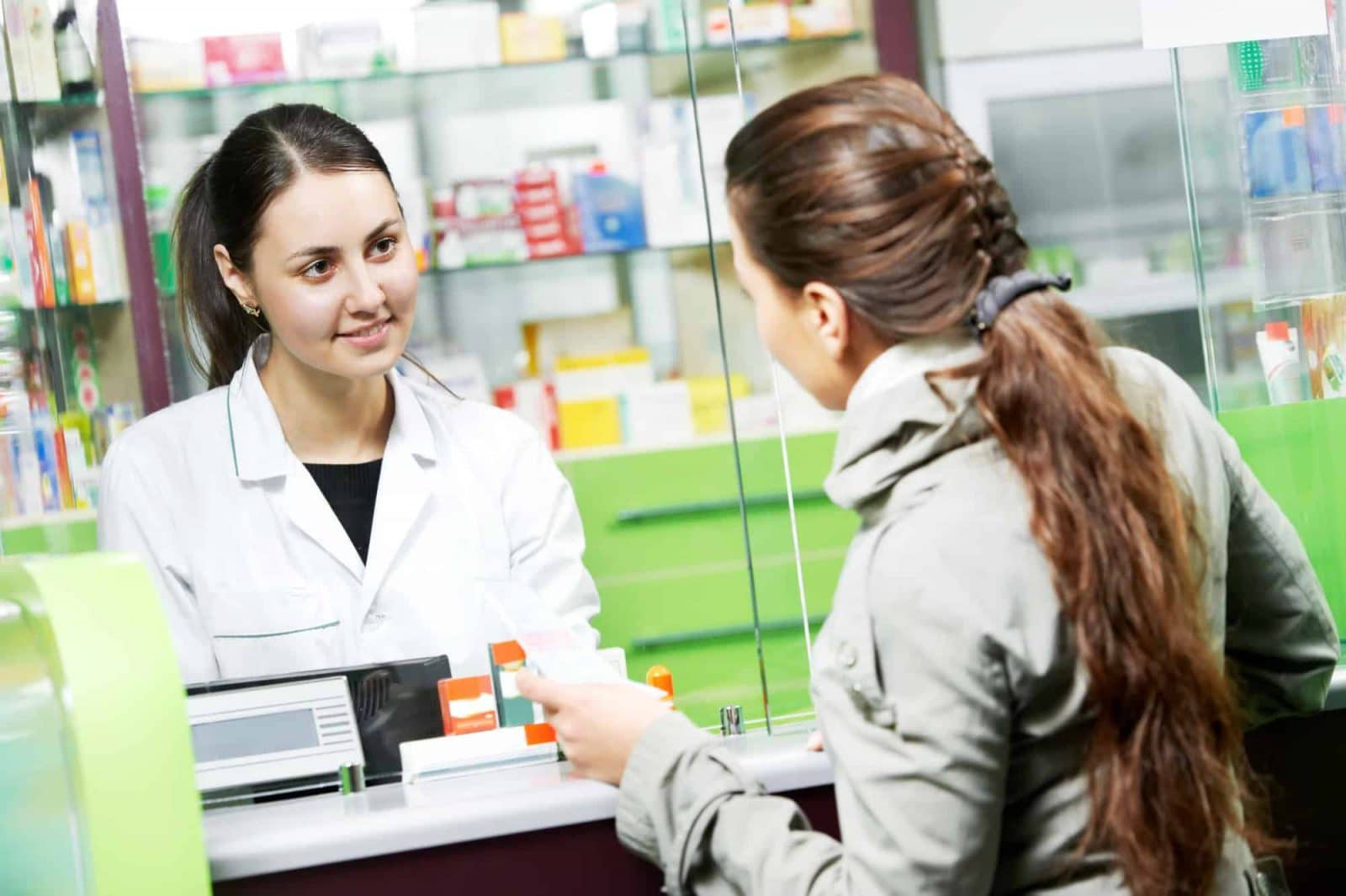

And credit cards are great if there is some kind of emergency. I get that. My dog, that recently had to be put down endured a horrible pancreatic attack about two years ago. She was vomiting, panting… and just overall – not well. I had no idea what to do. It was 9pm at night. I made the call to take her to the only “urgent” care we have for pets in the area. The bill…. $1200! Yes… $1200. I had to charge this onto a credit card. I did not have that kind of cash just laying around. I never do for that matter. Why? Because I don't have any kind of emergency fund. I honestly can't tell you why I don't. I mean, I can and I can't. First off, there is not a whole lot of “free” cash floating around my personal financial situation. My husband does have a wonderful 401K, pension and health insurance through his company. However – as I have shared with all of you before — we're also trying to keep two households going. One here in the town we live in, so that my daughter can graduate high school with her friends and then my husband works three hours away in a VERY expensive area (our area is NOT cheap either). And if you think trying to pay bills for one place is hard…. let me tell ya something!! We downsized CONSIDERABLY when we knew we were going to attempt this in 2013. We sold our dream home, we traded down on our cars, we sold half our belongings or donated them. And it's been….. exhausting and stressful in more ways than I can count. So I guess – to just be open about it all, I feel like there is never money to put in an emergency fund. But then… I'll spend $22 at Zaxby's here and there for two salads and two ice teas?!! Say I do this twice a month… there's almost $50 a month I could have saved. That turns into $600 a year.

So what do I do? What do you do? We WANT an emergency fund and the chances that we have a few bucks here and there to save are probably there – but we don't.

Along comes the answer…

Painless Savings with Digit.co

A while back, I was talking to a fellow NYR Organic Consultant. She was telling me about how she is saving a portion of her home business earnings and doesn't even notice it. I felt like this would be impossible. But she explained that she uses Digit.co. Now what exactly is Digit.co? Digit.co is a financial wizard… kinda. It's actually a program that connects to the financial account you prefer (for me, it's my business account that I use for all my home businesses like Avon and NYR Organic). Once Digit.co syncs and analyzing your account, it begins to “work” it's magic. Digit.co takes into consideration all of your spending habits. Your average bill payments, grocery purchases, loan payments, house payment(s)… etc. It does NOT share any of this information. It's simply to “discover” how and where you spend money so that it can “find” places here and there where you can save. What I mean by that is: Digit.co moves a little bit of money here and there each month over into a FDIC insured account. The amount is moves each time will vary – but I promise… it will never be HUGE. The program's algorithm (for lack of a better word) – does understand that you have expenses. It doesn't just “see” $1,000 and go.. “I'm taking all of it and moving it to your Digit.co savings account!” NO no no. I'd croak. It might be $1 this week and maybe $11 next week.

So let me make some super clear points about this program now:

1. Digit is free. There is no cost to you. Digit makes their money off the interest.

2. Your info is secure. Obviously, Digit wouldn't offer a service like this without the very best encryption and security.

3. You can access your money at any time. A simple text and you can withdrawal the funds you've saved.

4. Digit will never take HUGE amounts of money from your account. And guess what, they are so concerned about NOT putting you in any kind of financial bind, that they will pay for overdraft fees up to twice a year if their withdrawal caused the overdraft!

5. Though you don't earn interest, Digit offers a “bonus” program of sorts. They will reward you with 5 cents for every $100 you save!

6. Withdrawals for saving are gonna be determined by the “average” amount in your account. Digit is always monitoring this. So if you hardly have money in there, well, then savings will be lower than if you keep a balance of a few thousand dollars.

To give you a better idea of how often withdrawals happen and how much – the Digit site states:

How often does Digit save for me?

—This varies from user to user. Digit takes into account each user's unique financial situation for the day. It learns things like pay days, rent, recurring bills, spending patterns, and average balance to determine how often to save and how much to safely set aside.

—Most folks see 2-3 savings transfers per week on average. The savings amounts on average tend to be between $10-30. Please keep in mind that both the frequency and amounts can vary depending on the day/user. The range is from $0.05 to $150 in the rarest cases.

—You can dial in Digit's aggressiveness more to your liking as well by texting “Save More” up to 3 times.

—If you've increased Digit's savings by texting “Save More”, you can lower it back down by texting “Save Less”.

—You can text “Savings” to see your current Digit savings balance as well as the last 3 times Digit saved for you. You can also log in https://digit.co/signin at any time to see a complete history of your savings as well as your private savings journal.

Is Digit Right for Me?

Well – let's talk about that because I probably had some of the same concerns that you do. I was worried about sharing my banking info, but was assured by their security standards. I was worried they'd take lots of money several times a week. Nope, I've been very pleased with the amount and frequency. It hasn't come anywhere near my Zaxby's salad expenditures each month. So for me… it's averaging around $40 a month. And I know that's not a lot – but keeping it real — it's WAY more than I was saving! And if I hit $480 to $500 in a year's time, I will be have done it PAINLESSLY. I will also breathe easier because I am saving SOMETHING. This makes me happy in two ways. I will have some kind of emergency fund and I will not notice that it's being created.

Now – still keeping it real here…

If you're someone that keeps a really low balance most of the time — I'm thinking a firm NO on this. The savings is going to be so minimal and if your balance is already low, you don't wanna put yourself in any kind of bind. That's neither helpful or stress-reducing.

I Want to Get Started with Digit!

Cool! I love it. I hope we both have amazing savings stories to tell! And by the way, speaking of telling… if you share Digit with friends and they sign up – you can earn $5 each per referral. Hey – now that's nice cash going right into your ole savings fund!

**Update: Digit announced in April 2017 that they will start charging $2.99 a month for their service. So though it's no longer technically free, it's still very affordable.

![Bookscouter Review [Make Money Selling Textbooks and Used Books]](https://www.moneymakingmommy.com/wp-content/uploads/bookscouter-review.jpg)

![Mobee App Pays You to Mystery Shop [from you phone!]](https://www.moneymakingmommy.com/wp-content/uploads/2015/06/mobee-app-review.png)