This post may contain affiliate links. If you make a purchase through links on our site, we may earn a commission.

Acorns App Review: Is It Worth Going Nuts Over?

How Does the Acorns App Work – Full Review

As work-from-home moms, we try to stay informed about the latest money-saving apps out there, but one that’s been trending as of late involves investing.

Traditionally thought of as “for the men to worry about,” investing has been a male-dominated field which carries the stigma that it’s only for people who have disposable income. According to CNBC's article, 60% of Americans don't have $1000 for an emergency.

Well, this is 2019, and breaking the glass ceiling means more women investing than ever before in history. Technology is finding new, less risky ways for working families to do it with spare change. Even the busiest multi-tasking working moms among us can invest without having to take out time from our busy lives to think about it.

What is Acorns and How Does it Work?

An app-based micro-investment vehicle that operates utilizing your spare change, Acorns simply adds up investing funds by rounding up your purchases to the nearest dollar. Users can link as many credit cards as they want and watch their spending dividends accumulate and ultimately generate income.

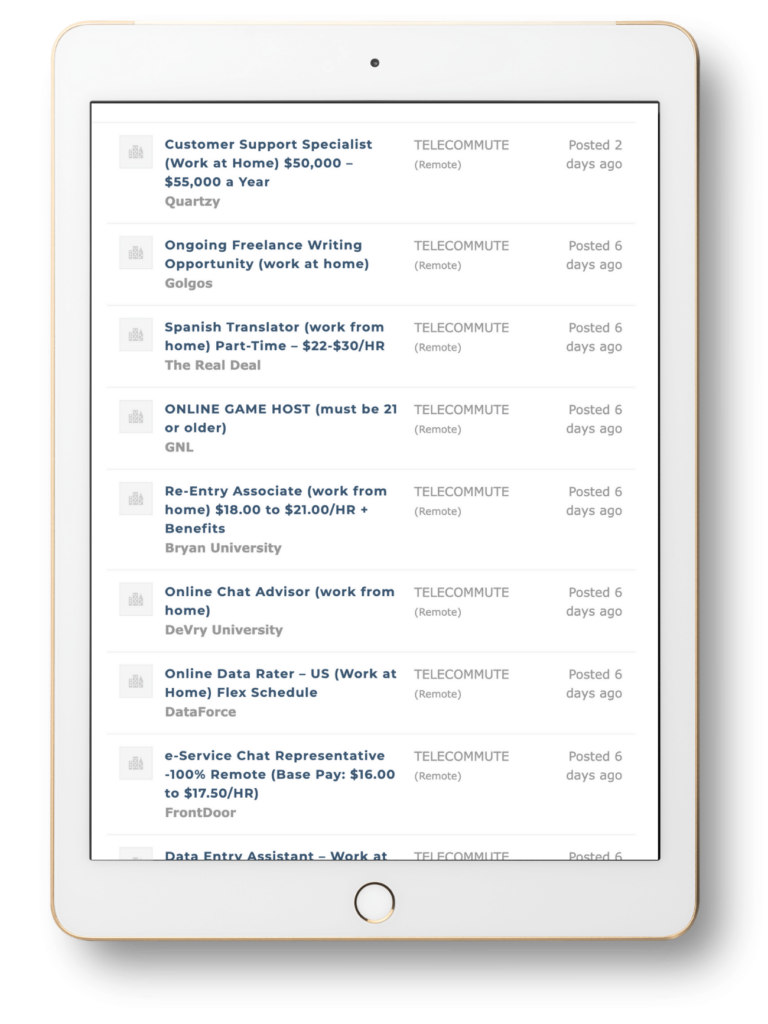

This money is withdrawn from your checking account once your round-ups hit the $5 mark. Choose an investment portfolio that makes sense for you on your own time, and let Acorns handle the rest. TIP: Want to have more money to invest? Read my post, Make an Extra $1000 a Month (Idea List)

Acorns App Highlights

There are a few characteristics that distinguish Acorns from the ever-revolving door of disposable apps – so let's dig into this Acorns app review:

Longevity. Founded in 2012, Acorns was one of the very first apps to pioneer the concept of utilizing spare change electronically. Previous generations simple saved their quarters, dimes, nickels, and pennies for their savings or investment purposes.

Now, the younger people are, the less they tend to carry cash, which made this groundbreaking concept ideal for the younger generation.

Adaptability. One of the ways we judge apps that have been around for more than a year or two is their ability to roll with the punches and adapt to interrupting technologies. Over time, Acorns has earned a reputation for remaining agile in a constantly changing tech landscape, while growing in popularity. Intuitive innovations to the user-interface have made it easier to navigate.

Financial Advice. Designed with a modern portfolio theory in mind, this app acts as a rudimentary financial advisor of sorts. When you set up your account, they’ll ask you some questions and recommend an efficient portfolio that makes sense for you based on your answers.

Versatility. As opposed to being a one-trick pony, you decide the level of risk you want to take with your investments. Acorn portfolios can range from conservative, or featuring mostly bonds, to aggressive, which contain more stocks and real estate ventures.

One of the most recently added Acorns features is the Round Up Multiplier. Users can now double their round-ups anywhere from 2 to 10 times your dollar dividends, meaning a 10 cent remainder could generate as much as $1 toward your investment.

Alternatively, they can opt to set up recurring investments that do not depend on your spending, meaning you can choose to invest a chosen amount of money each day, week, month, or year.

This feature positions Acorns to retain its customers for the long-haul, allowing potential for users to take them from college right on through to retirement.

Affiliate Companies. When you make purchases from a list of selected retailers, those companies deposit something called Found Money into your account. Popular retailers like Walmart, Airbnb, and apple pay a rate of 1-2% of your purchase price.

Who Should Use the Acorns App?

Acorns can be a nice, hands-off method for novice investors; college students and working families who aren’t currently able to save significant amounts of money to invest will find this to be an easy, low-risk investment option.

Though Acorns charges a monthly user fee of $1-3, they offer free service to college students, which is just one more incentive to take advantage of the app while you’re still in school.

Final Thoughts

As this program is app-based, its target market demographic is millennials who have not invested money before. If you’re an experienced and seasoned investor, you’ll likely find Acorn to be lacking in substance.

However, it features an intuitive and user-friendly interface, so anyone can use it, and with the recent changes they’ve made regarding adjusting the investment amounts, Acorns may just be your best bet for investing your spare change. Sign up for free – click here.