This post may contain affiliate links. If you make a purchase through links on our site, we may earn a commission.

Intuit Jobs: Work at Home as a Tax Advisor Averaging $18hr

Intuit Jobs That Offer Work at Home? YES!

Tax season is busiest time of year for accountants around the United States. It’s also a season where burn-out rates are high, so you might be looking for a new option to get you out of the rat race and into a home-based job. Intuit is a popular company that produces programs like TurboTax, QuickBooks, and Mint.com. Every year, Intuit hires seasonal home based workers to serve as tax advisors. These seasonal Intuit jobs occasionally even bring on remote workers for year-round positions. If you have the knowledge and experience to work as a tax advisor, Intuit could be the opportunity you’ve been dreaming of. Read on to learn more about how you can apply to work at home with Intuit.

What Does a Tax Advisor Do?

Intuit’s tax advisors work from home and help customers who need assistance completing their taxes using the TurboTax software. You will be talking with customers via phone, email, and live chat and offering guidance on common tax-related questions and concerns.

How Much Does It Pay?

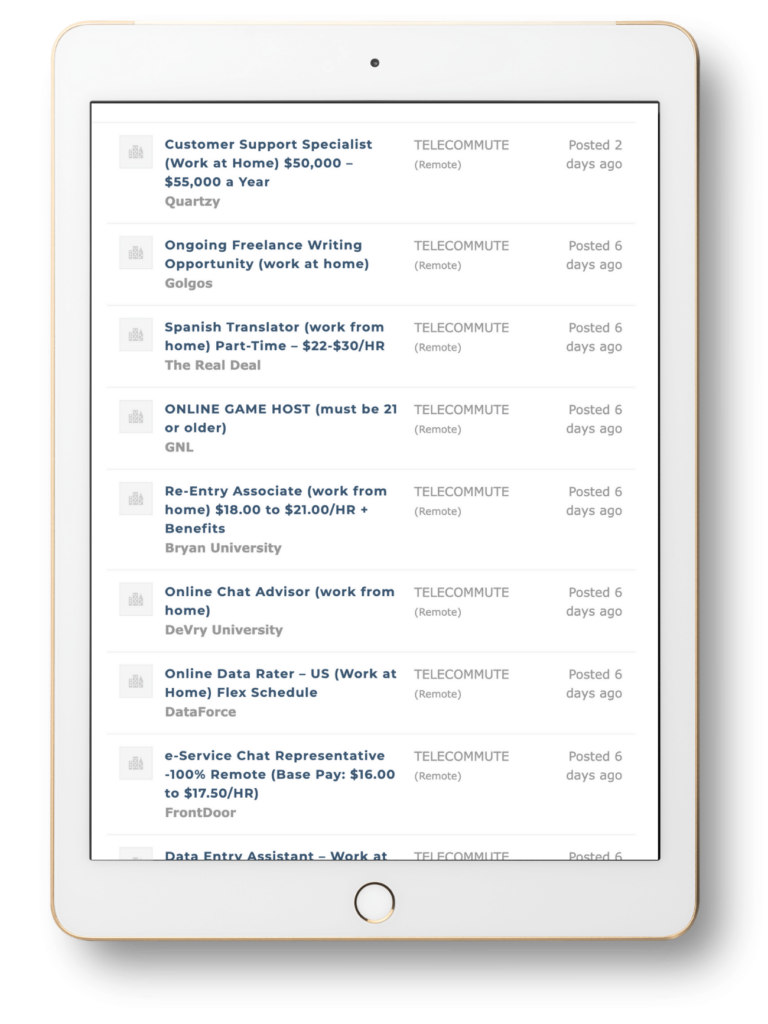

While Intuit doesn’t openly broadcast how much they pay remote workers, reviews online seem to point to an average of $18 an hour and sometimes a little more. In the past, the company also added bonuses for these seasonal Intuit jobs, reportedly up to $8,000 per tax season, but there isn’t any mention of bonuses on current job postings so that might not be something they routinely offer. Intuit offers both part-time and full-time remote positions and the average tax advisor will work between 30-40 hours per week. (See more work at home jobs in the Work at Home Directory.)

Am I Qualified to Be a Tax Advisor?

In order to work for Intuit as a home-based tax advisor, you’ll need some serious experience and credentials. You have to show proof that you have active credentials as either a Certified Public Accountant (CPA) or an Enrolled Agent (EA). You’ll also need an active PTIN and experience with electronic filing using tax preparation software. Tax advisors need at least five years of experience in preparing tax returns for both federal and state filings. You should be experienced with filing individual and business tax returns and have a working knowledge of current tax laws.

Additionally, you’ll need to have excellent communication skills and the ability to explain intricate tax issues to customers with very little financial experience. Because you’re working at home, you’ll need to be able to work with minimal supervision and be good at troubleshooting common software issues.

How to Apply

If you think you have what it takes to work from home as a tax advisor, the first step is to search for available positions and apply here. According to reviews from previous Intuit seasonal employees, you can expect to take a test to show your knowledge of tax law and your abilities to communicate well in basic English. You’ll also need to go through an interview with an Intuit recruiter.

Ultimately, Intuit is a legitimate company, offering a variety of work at home jobs for qualified tax advisors. If working at home appeals to you, this is definitely an opportunity you should explore.

![DoorDash Order Taker [Work at Home $10-$15 hr!]](https://www.moneymakingmommy.com/wp-content/uploads/doordash-order-taker.jpg)

![Work at Home as a Telephone Data Collector [Part-time & Flexible]](https://www.moneymakingmommy.com/wp-content/uploads/telephone-data-collector-job.jpg)